“Cause I'm T.L.T., I'm dynamite

T.L.T., and I'll win the fight

T.L.T., I'm a power load

T.L.T., watch me explode”

AC/DC Probably

Intro:

I’m sure by now you’ve been beat over the head about bonds, yields, inverted curves and why it’s all so important for recession, growth, blah blah blah.

Ok ok, actual inversion below:

You’ll notice that the 2021 curve has the longer (time wise) end with higher rates and that the current curve is flipped with lower end being higher. This is due to the federal reserves actions pushing the lower end up by issuing short dated bonds to pay for the US debts, but that’s a whole other story, let’s not get off track.

Today I want to discuss how to capitalize on this situation, because the iron is getting hot and it’s almost time to strike. Let’s take a look into TLT - iShares 20+ Year Treasury Bond ETF.

Set-up:

If you haven’t noticed the federal reserve has just hiked interest rates 5.25 bps in the last 18 months. To keep it simple, rates go up, the value of bonds goes down and their yield goes up. Well, in this environment that means that the value of TLT goes down as well, as it’s tracking 20 yr bonds. See the 3 yr weekly chart below which captures this unprecedented rate hiking cycle.

Ouch…..BUT, it’s time to turn this ship around, the recent bounce is off of all time lows, at least since this derivative has been traded. How does this look on an all time chart you may ask?

We have literally just reversed off of the bottom. Ignore the lines :). But why are we moving back up after getting crushed into oblivion for the last 3 years? One reason would be the easing of long term bond yields. Below is the current standing of the 30Y yield which is pushing the prices of things like TLT, up.

You might say to yourself with further introspection, why is the long end of the curve dropping? It’s your lucky day, because we know that too! Why of course it’s because inflation is easing and the market is FINALLY buying into the fact that the Feds policy on interest rates is about to reverse in the somewhat near future. On this point however, there is a fair amount of disagreement as to when the Fed will pivot.

All said, the set-up here to long TLT is that you’re playing the easing of Fed Policy. This policy is driven by things like Jobs, CPI (consumer price index), PCE (personal consumption expenditures) etc. So let’s see some of those economic data numbers next.

Economic Data:

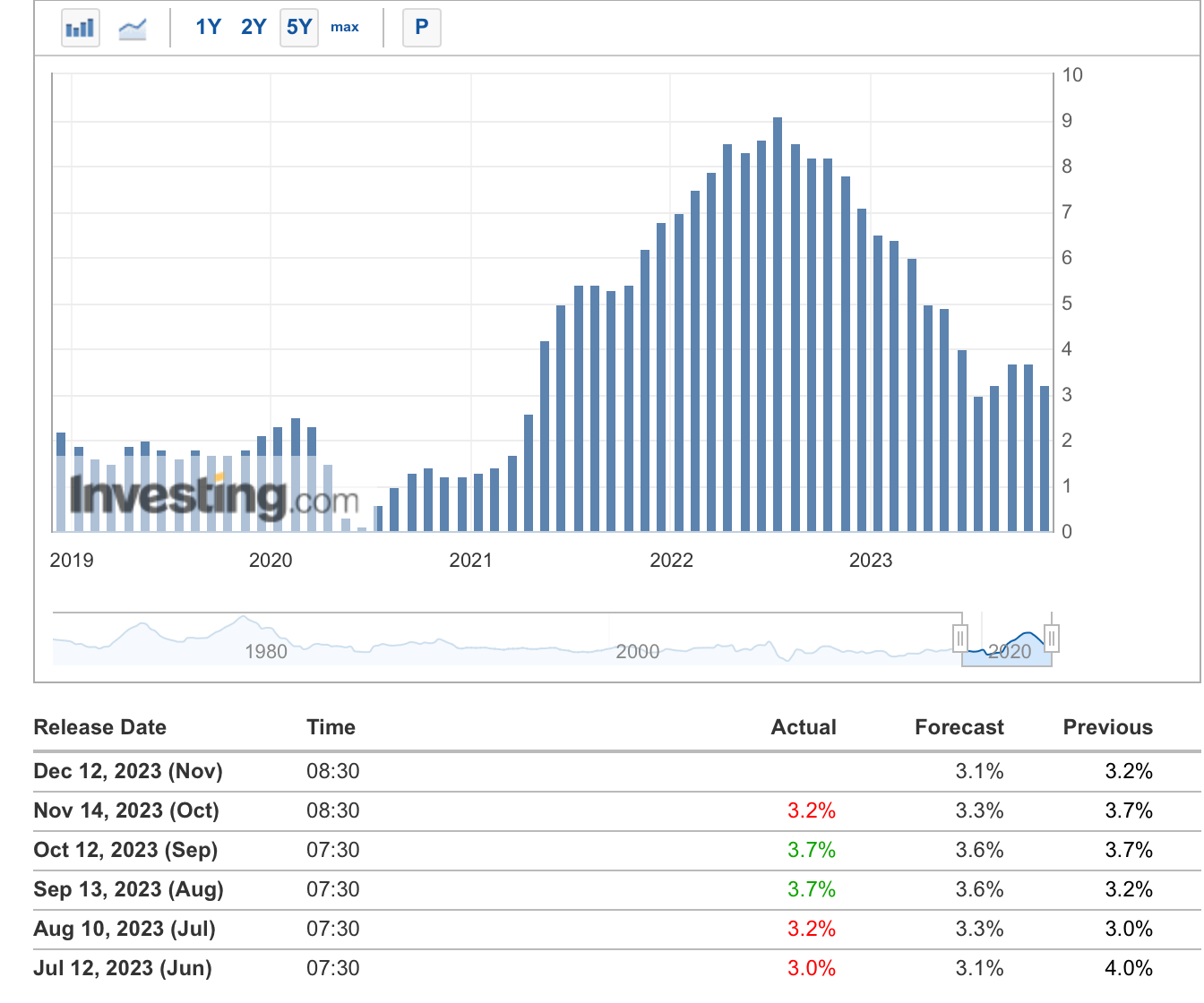

Let’s start with CPI and all its various iterations:

Here we have the YoY headline CPI, this is the CPI without anything taken out, this is all of the things, housing, energy, food and so on. You can see here that we are trending down to the Feds target of 2% and I expect we break into the 2s at the reading next week, and if not, in the Jan reading. The market is going to freak at a 2 handle and yields will plummet, thus sending TLT, TMF and so on, up up up.

Next let’s look at Core CPI - this is the measure excluding energy and a couple of other items.

This is the YoY core, now, this one looks sticky and it is. Turns out food and energy have major impacts to headline. But lets peak at month over month.

Let’s do a little math and only look at the last 5 months, you’ll come in a 0.24% on average which annualized to, you got it, 2.88%. The Feds goal is 2%, we are more or less there, do you really think they are going to hike further? Or is it more likely that cuts with be the new topic in the next 3 months?

However, we need to look at their favorite measure, PCE, MoM only this time.

More quick math here, annualized 2.4% based on the last 5 months. Hummmm. Alright, this is growing long in the tooth, lastly let’s see the jobs numbers that just came out.

Non-Farm Payrolls - 199K just above the 190K estimate - nothing of note here.

US Unemployment rate - actually went down from 3.9% to 3.7% this week. Maybe this makes the Fed more hawkish? But it puts to bed recession for a bit.

Jolts - job openings data - 8.7M v. 9.3M expected - ok this number was indeed soft but the Fed does want to see some softness, this coupled with dropping inflation should be enough for them to start considering a pivot. It’s important to note this number is still VERY high historically.

The last thing I will point out here is the PMI data for manufacturing and things like sentiment and inflation expectations. Manufacturing PMI is back over 50 in all cases, indicating we are back to growth. Sentiment is as high as it’s been in 12 months, inflation expectations on a 5yr and 1yr timeframe have both dropped to recent lows meaning that the general public is feeling as good about inflation as they have in along while. All things that will bolster the market, including TLT.

Potential Negatives:

There are a couple here - one, the Fed will come out super hawkish this week at their meeting, Jerome Powell (loving referred too as JPow) will lay the hammer, regardless of the data we get for CPI or any of the other data we have had recently. This may happen for them to show continued strength in their monetary stance for the sake of respect from the market.

Another would be that the CPI print will come in hot, this will almost certainly make yields yeet and the TLT skeet.

Fed speaks softly in the coming FOMCs but carries a big stick by keeping rates above 5% well into next year, defying general consensus that they will cut by April. This data can be found in the Fed watch tool below showing the % chance they cut. Right now it’s roughly 50/50.

Conclusion:

I don’t see how the TLT goes any lower from here, even if the fed holds you aren’t going to see much above 5% again on the 20Y without something seriously bad happening. We’d need to see inflation start to spike or something else that would prompt the Fed to increase rates further.

Data is seemingly pointing, at the moment, to a soft landing. We may not get that, but it currently looks to be many months away from happening if the plane does come down hard. I expect CPI to be very good this month and next. Oil is at lows rarely seen since the war in Ukraine started, this alone will bring down CPI as it’s a part of all other CPI data. Assuming the Fed does nothing but hold their line, and jobs come in in-line, bond yields will continue to drop and TLT will keep going higher.

The market has front run this a bit already, as seen in the recent move up above, but historically these are still very good levels to buy into TLT. I currently hold some shares in both mine and my daughter’s accounts in the mid 80s. I also hold a very small TMF position which is the triple leveraged option (RISK). My plan next week is to get some put credit spreads ahead of CPI Tuesday 12/12/23. Then see what the Fed says 12/13/23 before adding to my longs or considering calls (Possibly get a few for fun before CPI). The Jan 19 90/85 spreads look decent for a 10% return on risk for a moderately safe play and a little over a month till expiration. I still haven’t decided yet.

“It does not do to dwell on dreams and forget to live.”

― J.K. Rowling, Harry Potter and the Sorcerer's Stone

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/mehmehmeh

Closing 100% on the PCS I opened. We got soft data and dove. Santa rally coming.