Intro:

Let’s have some fun, this is outside my normal “The case for or against posts”. Over the last week meme stonks have made a comeback. It felt like 2021 all over again, as the nostalgia washed over us. With the backdrop or Roaring Kitties return and the GME saga, I wanted to focus in on a trade I made this week with Faraday Futures (FFIE). Not everyone pays attention to penny stocks, so it may be news, the stock has moved up several thousand % in a week from 0.05 all the way over $3 and back down again at market close to $1.02 finish after hours at $1.13. The question is, after this amazing return over $1 from nearly 0, is the juice worth the squeeze?

Let’s start with a little history lesson:

I could use GameStop (GME) as an example but I prefer to use the 2023 NKLA run as it’s an EV company that was in a similar situation. Plus every-one knows the GME backstory by now.

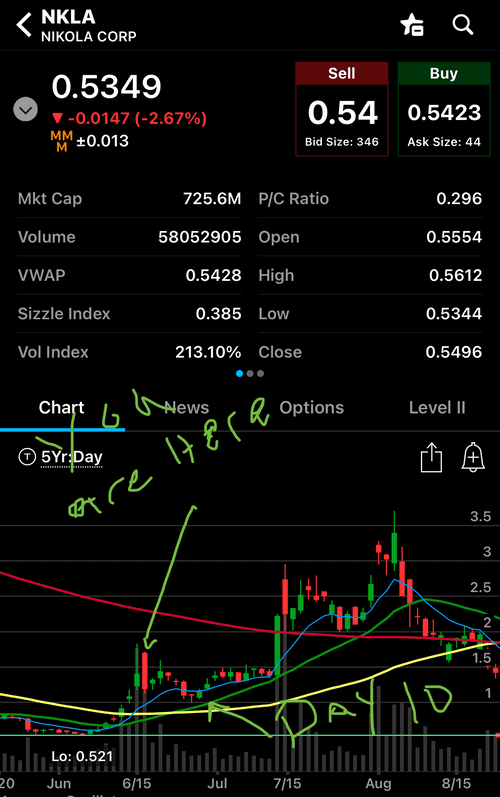

Here is a flashback to a the $1 breakout on NKLA last year. The chart below may look familiar, but the similarities don’t stop there….

The beginning: In early 2023 NKLA was languishing under $1 and heavily shorted, nearly 50% at the time. It was also on notice from the Nasdaq that they needed to get their stock above $1 to remain compliant to stay on the exchange. (Just as FFIE is today) On June 14 2023 NKLA broke above 1$ on heavy volume which followed through for 4 days. Ascending from 0.50c where it had been for months. The massive push through in volume lead the stock to nearly 2$ on 6/15. The following day 6/16, as you would have it, was Opex. Just like today for FFIE…hummmmm. The shorts forced the stock down to close at $1.19 trying to get it back under 1$. A lot of investors were spooked and the volume dropped off the following week.

The Hodl: On 6/27 the shorts were able to move it all the way back to 1$ but could not break that level during normal trading hours which is what matters for listing purposes (being under 1$ after hours or premarket does not count, this is important). The following day, 6/28 marked the 10th trading day for NKLA above 1$, that week the Nasdaq cleared them from the delisting list and the rest was history.

The squeeze: After being stuck just under the previous high at $1.50 for a few days it became clear that it was not going back under $1, on 7/13 NKLA broke out again where it preceded to continue moving up another +100% to $3.71 on 8/3 reaching its high water mark before the company ran into litigation trial for their previous CEO and truck fires.

Where is FFIE: it’s on day 2 of compliance. 8 days away from being removed from the listing and no potential catalysts until 5/28 (not confirmed) which happens to be earnings day and a day before the 10th day required to get off the list….

Oddly enough the earnings call and report almost lines up perfectly for 10 day of compliance on 5/28. If I were management I would be doing everything possible to hype around that event given this new breath of life from investors. Any bit of good news timed with coming off the list will rocket this stock back to today’s highs and likely beyond, however short term it may be.

Differences between NKLA and FFIE, focusing on Short Interest, Market cap and Shares Outstanding:

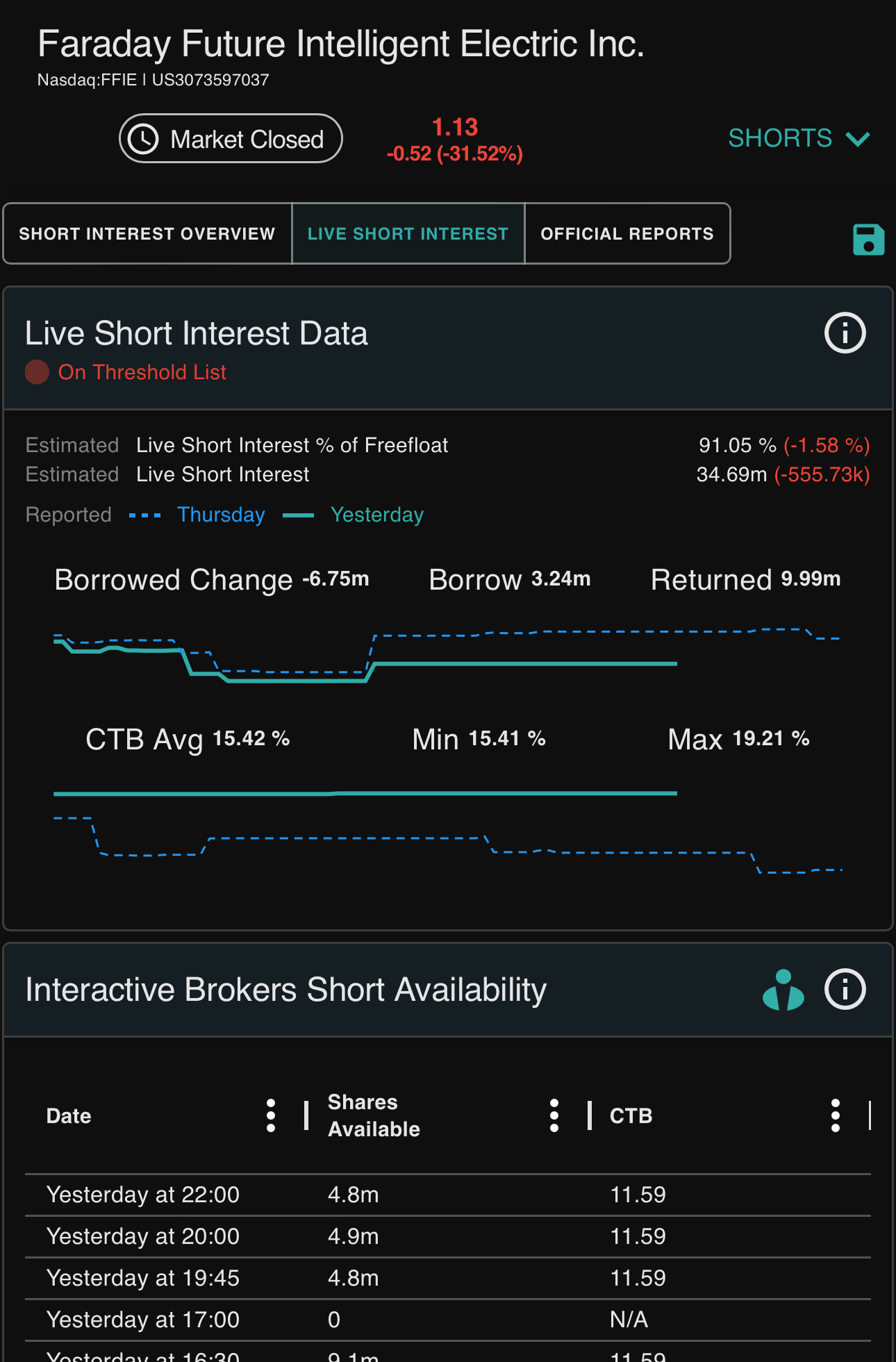

You may think, well NKLA only made it to 3.5$ and FFIE already did that today, well, NKLA was over 1B MC and had nearly 1B shares outstanding when it broke $1. FFIE only has 46m shares. Not even 1/10 the size and a MC under 50m. It’s a heck of a lot easier to move on volume, both ways. Expect major volatility. The other main difference is SI (Short Interest) %, NKLA was around 50% of the float, as of today, even after this weeks events, the SI still sits above 90% for FFIE.

Not only that, the cost to borrow is over 15% - anyone short is losing money on interest, Every. Single. Day, on the 35m shares short. There is only one thing that matters now and it’s painfully obvious based on the price action Friday….staying above $1.00.

Also that the 200MA on FFIE is way up at $7.50. When NKLA made its move it tapped its 200MA and even broke for several days it before failing below. Stocks that squeeze tend to reach that 200MA level.

Well what happened 5/17?

Yesterday was opex so there was loads of incentive to smash this down to take options OTM (imagine strikes all the way above $3 being ITM and potentially exercised into shares that could not possibly be delivered?).

If you watched the tape from 3:50-4:00 EST you could tell it was being heavily defended at 1$ to keep it above for the second trading day. Nothing else really matters in the next 8 trading days other than keeping it above 1$, it can dip below all it wants pre and post market as long as it closes regular trading hours at 4:00 EST over $1.00.

That being said, 0.5c and 1.00c (calls) still finished ITM and could be exercised, that’s potentially hundreds of thousands of shares, they have to come from somewhere. The dump from 1pm -4pm saved MM a lot of grief. Whether it’s coordinated or not, it’s a least oddly convenient. This was also timed with the main subreddit for the stock being taken offline. 🤔

The $1.00 mark will be a clear battle ground until FFIE regains compliance, if that is lost and it closes below, then it all goes out the window….but it didn’t, yet.

What’s next?

There isn’t another Opex till mid June as this stock doesn’t trade weeklies (take option fockery off the table, for now). IF volume remains elevated, I think this goes back up in the next two weeks as there will also be speculation around what they say during the earnings call 5/28 and getting off the NASDAQ’s naughty list. The earnings call timing is very interesting. The letter from the Nasdaq saying they regain their compliance will be a big short covering day....that would be 5/30. Any bit of good news, financing, debt restructuring, cars sold, manufacturing uptick, grants and so on, will cause this to rocket along with the listing back on Nasdaq. The stock is already priced for bankruptcy. The risk is clearly to the upside. The enterprise value of the company is nearly 200m and the market cap only 50m.

Conclusion:

I know this is a long read in today’s world, but it lays out what has been seen before and what can be done again. Theoretically it should be easier for FFIE to regain compliance than it was for GME and NKLA. There are fewer shares in the float, so fewer investors needed to hold a larger % of said float. The bulk of investors (share count wise) got in at a lower price also, NKLA bottom was 0.5c and FFIE was 0.05c, GME never got that low. So loads of shares are locked up at very low levels if those individuals choose to hold.

Full transparency, I started exiting my positions when $1.60 started to fail and made a decent return. I re entered just above $1.00 in the evening once I saw how the price action presented itself into close and that the stock held for the second day above $1.00.

This could die immediately in pre market on Monday and never recover that level, which would be a shame. The company, while not under the best management and a suspect product, has clearly been targeted by predatory shorting. A stock should never have almost 100% of its float short, or 50% really. This is MM throwing hundreds of millions at a sure thing, because they can, at the detriment of a company.

All in all I think it’s an interesting set up that’s worth exploring.

Happy Trading.

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/mehmehmeh