“You can check out any time you like, but you can never leave”

Eagles, Hotel California

Intro:

Robinhood (HOOD) is known for many things aside from its pretty UI. It was quite possibly the center of one of the most unique, singular moments, in the history of the stock market in early 2021. Just mentioning this illicits a lot of emotions, without even mentioning the event. Any investor born after the year 2000 knows what I am referring too. But we aren’t here to rehash the past, its time to look towards the future.

Speaking of the future, here are a few things we will cover.

Gold card 3% match / Ira 3% match / 1% match deposits/ UI features / UK expansion / 24 hr markets / Futures Trading

Walled Garden / Sticky Product:

The corner stone of my thesis is that Robinhood is building itself a walled garden. Key to this is its ability to make their UI and offerings so sticky that you will find yourself trapped in their web. Lets break it down.

First I will list some of the recent offerings that are unique to Robinhood that you won’t find on other platforms.

24 Hour Markets:

Here are some key highlights: Since launching the Robinhood 24 Hour Market less than a year ago, customers have traded more than $10B in total volume during the overnight session. * On our busiest days, as much as 25% of the total daily trading volume has come from outside of traditional market hours.

Robinhood Gold Card:

HOOD recently unveiled their new credit card at their Gold Event. Offering 3% cash back on all purchases with exclusive benefits it will be the only card of its kind on the market.

3% IRA Match:

Robinhood also rolled out a 3% match on all 401k rollovers, this has been wildly popular as seen in its recent inflows.

Robinhood Retirement has crossed $4B in assets, more than 2X since the start of the year. And over 25K people have transferred retirement assets from other brokerages into Robinhood so far in 2024.

1% Match on ALL deposits:

Along with the 3% credit card, HOOD will offer 1% match on every deposit you make for life. Note - ALL, FOREVER. To add to this, you could theoretically take the 3% you get from your credit card and roll that into your brokerage for an additional 1%! This seems like a no brainer, which will funnel more money into trading.

UI Overhaul:

Also part of the Gold Event linked above was their rollout of a new UI. Even for those who hate HOOD, they will admit that the UI is the best looking of all the mobile interfaces. People have long hoped HOOD would be bought out by Fidelity and the like so they could get their UI implemented for their accounts. The new UI looks to improve on that popularity. Seen below, it will offer a myriad of widgets that are full customizable. This alone with chart improvements in the past year have turned the Robinhood interface from just a trading platform to also one you could use for analysis. I expect this trend to continue as they build out in a slow manner that matches the vibe that exists within the current UI that so many love.

The other items worth noting are the expansion into the UK where they are now approved for trading. I expect this to continue as they attempt to roll out further into other EU countries. And also they plan to roll out futures trading in H2 of 2024. This is a lot to process. Robinhood is trying things, things that no one else is doing, and it really sets hem apart. Imagine being able to trade crypto, roll it into options and then into futures contract all on the same trading day…and they make commissions on all of that.

The stickiness is that they are pulling in new users with these new offerings, and the offerings do not come without strings attached. If you have ever rolled a 401k, you know once you’re in, you’re stuck. Unless you want to create a tax event and pay taxes on your gains. The other piece is that you will need to stay in your various HOOD accounts to keep the 3% and 1% matches. I imagine much the same for the credit card, once you start using it for travel, rewards, etc. you will want to move more things into the HOOD ecosystem.

This build out of offerings in which lure and keep users is very similar to how Apple (AAPL) built their ecosystem. Once you’re in, it’s hard to get out.

Chartology:

(Yes, I still use ToS for charting LOL, for now)

Below is the max weekly chart, you can see the SMA are stacked for the first time since IPO. Also, the pattern of higher highs and higher lows is very promising as it looks to break back towards the $34 IPO level.

The daily looks great as well, a retest back down to the previous resistance at $14 isnt out of the question but if you’re looking to hold for years, even at $17 this bounce off the 50 SMA is a good spot to start a position.

I don’t have much else to say here - other than its trending in the right direction from a longer term perspective.

Finances / Statistics / Earnings:

One of the first things I want to note is their recent Assets Under Custody (AUC) at the end of February were $118.7 billion, up 16% from January 2024. Net Deposits were $3.6 billion in February, translating to a 42% annualized growth rate relative to January 2024 AUC. Over the last twelve months, Net Deposits were $21.6 billion, translating to an annual growth rate of 29% relative to February 2023 AUC.

Trading Volumes in February were higher across all asset classes relative to January 2024. Equity Notional Trading Volumes were $80.9 billion (up 36%). Options Contracts Traded were 119.1 million (up 12%). Crypto Notional Trading Volumes were $6.5 billion (up 10%).

Janurary had much the same look to the prior month in which trading volumes and user assest were growing at a significant level.

Robinhood burns alot of cash, but they are also flush with years of runway at nearly 11B total cash. Their Debt ratio is also realtively low.

As far as share statistics I always like to look at Institutional holdings, its significant at 78%. Cathie Wood holds a massive amount in her ARK funds. The other item I look for is short float, it is fairly large at 4.36%. But that isnt terribly alarming….yet.

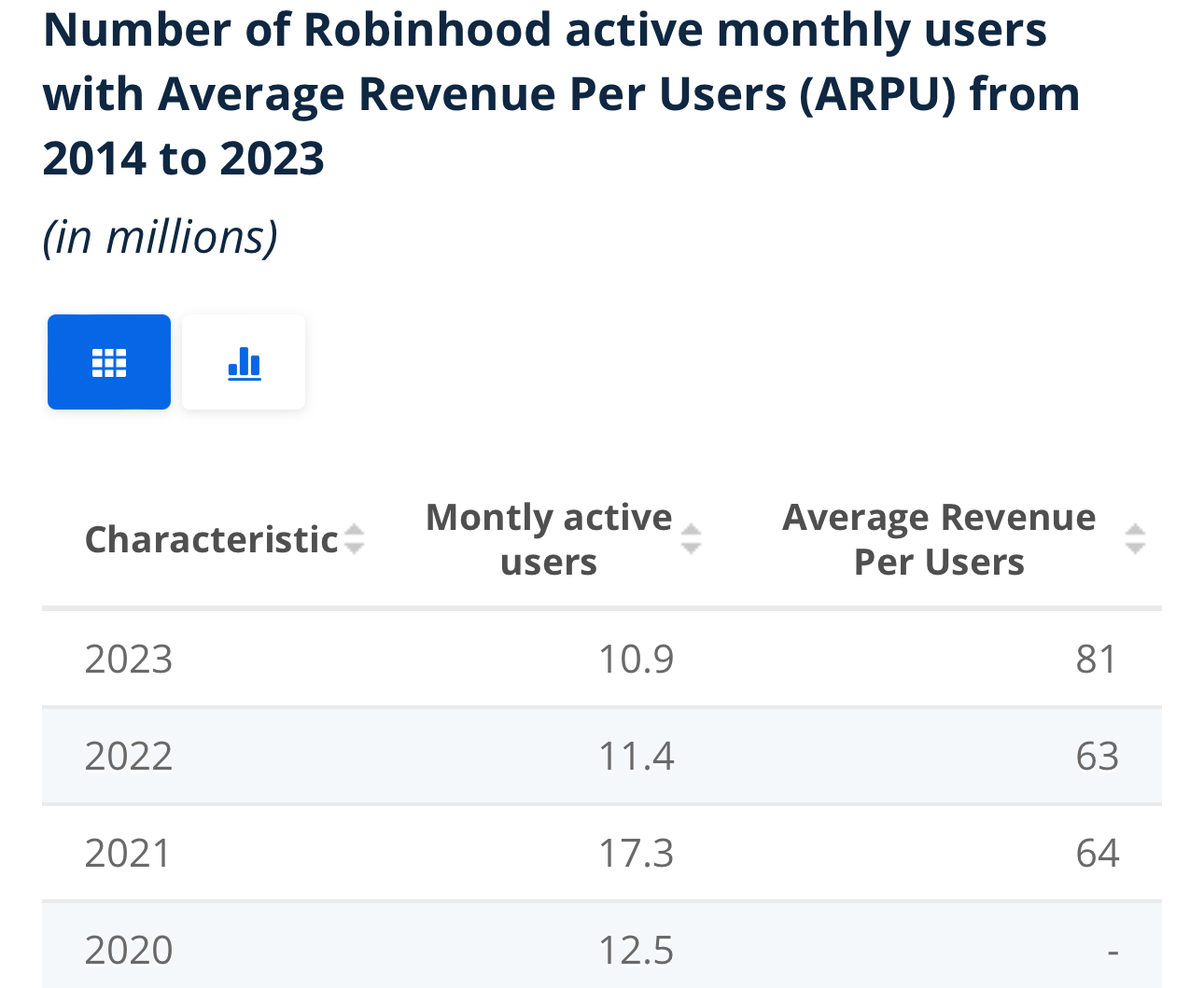

This was implied above with new incoming funds and increasing trading volumes, but the data below supports the increase in revenue being seen per user. User numbers will continue to recover, but the number that really matters is that the ARPU continues to climb.

If earnings were to meet expectations of 0.04 this quarter, that would make 3 of the last 4 quarters in which HOOD has positive EPS, close to a full year. I like to see this is trending and nearly breaking into profitability.

No long term debt. Rates aren’t hurting them on any loans. If anything it’s helping with cash being used in treasuries.

Margins across the board are trending up the last year. This isn’t even capturing the massive Q1 bull market months.

The same can be set for Revenue and Income, both headed into the right direction. Net income will likely go positive this year.

All in all, I like the position HOOD is currently in from an earnings and financial standpoint. They do burn a ton of cash, but it’s one thing they have plenty of, and as they tip toe into profitability in the coming quarters, it will no longer be a concern. I expect an EPS beat 0.06 for this quarter. The bull market has helped. Look no further than Morgan Stanleys (MS) recent ER. Their brokerage and trading commissions killed it, trading volumes the highest seen since 2021. I also expect that to be the case for HOOD.

Potential Cons:

I mentioned the cash burn but there is also the potential of future R&D expenses and legal fees as they expand their platform and trading footprint internationally. We will have to see how much this weighs on them in the coming year.

Of course, there is always the potential for a market crash as well, this would be bad news for any brokerage much less one that is barely profitable.

Last I would like to point out the short interest below. It is near peak IPO shorting. I dont want to read too much into it, but it does mean bearish bets are near an ATH as we head into Q1 earnings.

Conclusion:

HOOD currently sits just above $17. I have a 3150 share position at $17.37 and I have been selling covered calls, headed into earnings 5/8. They are building out a great suite of offerings. The platform is advancing at a good pace and their finances are trending in the right direction. Regardless of their past history and person feelings, they seem poised for success. I would also not rule out a buyout at some point down the line, though I dont think management wants that. If they can continue to innovate in the space while making their platform hard to leave, the growth will be there.

As for price targets, I don’t really have one. There is resistance on fibs up to $23.75 and then above that there is nothing but air till the IPO price. Depending on earnings I could see this back in the $30-40 range over the next 1-2 years, assuming the market doesn’t crater. My best guess is a FY EPS of 0.2, which would give them a PE at the current price of 85. This is high, but if the growth looks anything like we are seeing in Q1, it will be justified.

Happy Trading.

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/mehmehmeh