Sherwood Forest Goes Digital: Robinhood's Crypto Takeover

Robinhood stock HOOD 0.00%↑ is coming off a record year as shares nearly doubled, pending crypto offerings and premium subscriptions flourish. The broker is aiming to beat out traditional firms as the go-to financial platform for a new generation of investors — and the $100 trillion in assets they're expected to receive over the next decade.

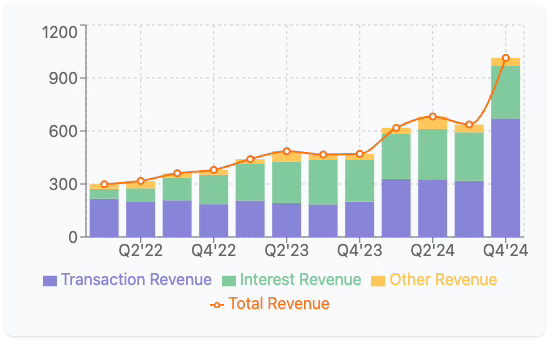

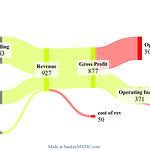

Robinhood (HOOD) on Feb. 13 reported full-year earnings of $1.86 per share, up 215% since going public in 2021. That beat market expectations of a 9-cent loss by a slim 31 cents to $2.02. Revenue jumped 35% year-over-year, driven by strong gains in crypto and options transactions.

The December quarter marked the first time Robinhood crossed the $1 billion revenue threshold in a single quarter, reaching an astonishing $1.014 billion as transaction-based revenue more than doubled to $672 million.

Mo' Money, Mo' Problems (But Mostly Mo' Money)

Crypto-nite: Robinhood's Kryptonite for Traditional Banks

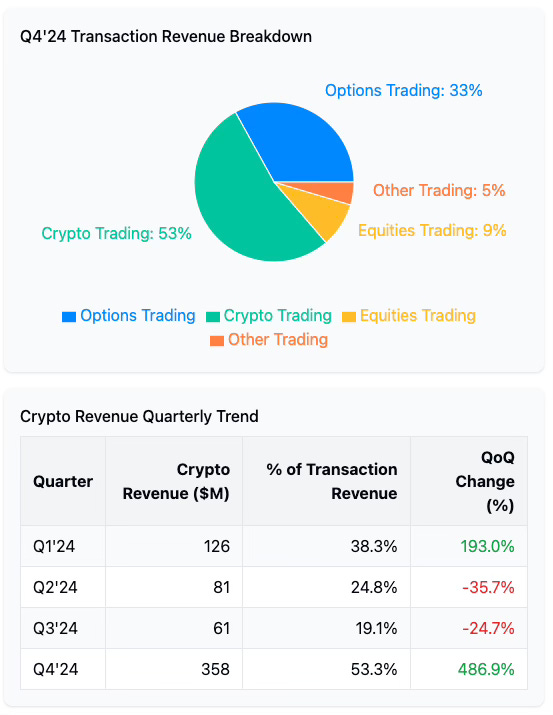

The company's upward trend comes from cryptocurrency trading, which vaulted 487% year-over-year to $358 million in Q4 2024. This explosive growth means crypto now represents 53.3% of all transaction-based revenue, up from just 21.5% a year earlier.

"Cryptocurrency transaction revenue picked up to $358 million as users trading cryptocurrencies grew by 106% in the fourth quarter, while the number of daily active traders surpassed 600,000," noted CFO Jason Warnick.

Meanwhile, other transaction revenue segments showed healthy growth, with options trading reaching $222 million, equity trading at $61 million, and other trading revenue hitting $31 million in Q4 2024.

Shiny New Toys: Robinhood's Product Playground

"We did the year on product development and made significant progress with the release of the company's Gold Card for its premium subscribers in both the U.S. and European Union. We see a huge opportunity ahead plan to deliver an industry-leading offering, anywhere to buy, sell or hold our financial assets globally and across crypto, stocks, options, and bonds," Robinhood CEO Vlad Tenev said.

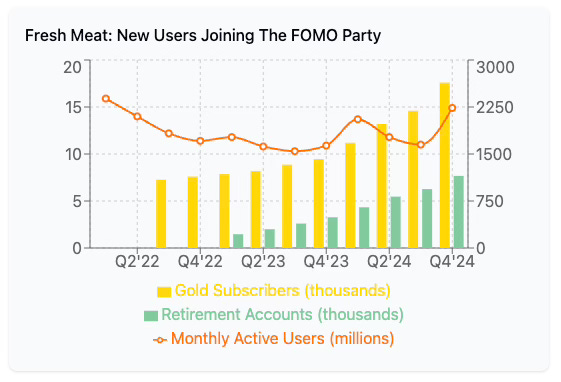

Robinhood in March 2024 bolted on offerings for its Robinhood Gold premium subscription service and partnered with Visa to help launch a credit card for subscribers. Robinhood Gold Card offers 3% back on all purchases with no annual fee and an unlimited number of subscribers hit 2.6 million in the fourth quarter.

Gold subscribers have more than doubled year-over-year to 2.64 million in Q4 2024, up from 1.42 million in Q4 2023. Retirement accounts have also seen impressive growth, reaching 1.15 million in Q4 2024, a 135% increase from the previous year.

Portfolio Empire: Assets Under Custody

Assets under custody (AUC) hit $191 billion in Q4 2024, an 87% increase year-over-year and a 26.5% jump from the previous quarter. This dramatic growth puts Robinhood on track to become a major player in the wealth management industry.

While equities still make up the largest portion of AUC at $131 billion, crypto assets have nearly doubled since Q3 2024, reaching $35 billion. This surge in crypto AUC coincides with the significant increase in crypto trading revenue, further highlighting the importance of cryptocurrency to Robinhood's growth strategy.

Shopping Spree: Robinhood's Corporate Collectibles

Robinhood followed product launches with key acquisitions, signing a $200 million deal to acquire TradeWeb, a regulated portfolio management platform currently operating in multiple states.

"The purchase is expected to close in the coming quarters. Adding TradeWeb has been a key focus for the company as it expands its cryptocurrency products," Warnick explained during the earnings call.

During the quarter, the company also announced a deal to purchase London-based exchange Bitstamp for €110 million ($119 million) to "significantly accelerate" its crypto business. With the deal expected to close in the first half of 2025, Bitstamp's core spot exchange provides Robinhood with a strategic foothold in the European market.

Cash Money: Profit Margins Going To The Moon?

Perhaps the most impressive aspect of Robinhood's Q4 2024 results is the dramatic improvement in profitability. Net income reached $916 million, a staggering 2,953% increase from Q4 2023's $30 million, representing a 90.3% profit margin.

This remarkable profitability surge suggests Robinhood has reached a crucial inflection point in its business model, where its fixed-cost infrastructure can now scale efficiently with increased trading volume and user growth.

The Bottom Line: Robinhood's Financial Health Report

Crypto Domination

Q4'24 shows a massive 487% YoY increase in crypto revenue, reaching $358M and representing 53.3% of all transaction revenue. This surge coincides with Bitcoin's meteoric rise after President Trump's election victory.

Profit Explosion

Q4'24 net income of $916M represents a staggering 2,953% increase from Q4'23. The 90.3% profit margin suggests Robinhood has reached a dramatic inflection point in its business model scalability.

Premium Subscription Growth

Gold subscribers have more than doubled year-over-year to 2.64 million, while retirement accounts have grown to 1.15 million. This creates a more predictable revenue stream as the company diversifies beyond trading.

AUC Milestone

Assets Under Custody hit $191B in Q4'24, with crypto assets doubling since Q3'24 to $35B. This 87% increase YoY suggests Robinhood is positioning itself for the "$100 trillion wealth transfer" opportunity ahead.

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://www.tradeotter.com/hub/profile/InvestwithMEH

Share this post