Robinhood's Tokenization Play: The Beginning of a Cross-Asset Blockchain Revolution $HOOD

Thoughts 20Mar2025

Robinhood's Tokenization Play: The Beginning of a Cross-Asset Blockchain Revolution

By Invest with MEH

Robinhood Markets Inc. HOOD 0.00%↑ is making an ambitious move into the tokenization of traditional equities, potentially reshaping how assets are traded while opening a new high-margin revenue stream that could transform the company's financial outlook.

The fintech pioneer's exploration of equity tokenization represents just the first step in what could become a comprehensive blockchain infrastructure spanning multiple asset classes—from options and cryptocurrencies to event contracts and even mortgages (maybe).

Tokenization: The New Frontier

Robinhood's initiative would allow investors to trade tokenized versions of stocks on blockchain networks, making them available 24/7 with potentially lower transaction costs and near-instant settlement.

"You don’t have to squint too hard to imagine a world where stocks are on blockchains… The cost of running a crypto business is an order of magnitude lower. There’s just an obvious technology advantage." - Vlad Tenev

It's about creating entirely new financial infrastructure where previously siloed markets can interact seamlessly.

The move comes as the Trump administration signals unprecedented support for crypto innovation. Treasury Secretary Howard Lutnick's recent regulatory framework has cleared significant hurdles for financial institutions looking to integrate blockchain technology.

"We're seeing regulatory clarity that was unimaginable just months ago," said a senior Robinhood executive who requested anonymity to discuss ongoing projects. "The administration's approach has effectively given us a green light to innovate in this space."

The Margin Story

For Robinhood, the financial implications could be substantial. While the company's traditional equities business operates on smaller margins due to the race-to-zero commission structure that has dominated the industry, blockchain-based services offer dramatically different economics.

Analysts project that tokenized asset platforms could generate margins as high as 60-70%, compared to the 5-15% seen in traditional brokerage operations. This stems from several factors:

Reduced intermediary costs with direct blockchain settlement

New fee structures for 24/7 trading access

Cross-asset collateralization capabilities

Premium services for institutional clients adopting the technology

"The margin profile of blockchain-based financial services is potentially transformative for Robinhood," noted Devin Ryan, analyst at JMP Securities. "This could shift their revenue mix toward significantly higher-margin business lines while actually reducing costs for end users."

The Cross-Asset Opportunity

What makes Robinhood's approach particularly noteworthy is the potential for unprecedented asset interoperability. In a fully realized blockchain financial ecosystem, users could:

Use tokenized equities as collateral for crypto loans

Trade options contracts directly for event prediction market positions

Exchange mortgage-backed tokens for equities without intermediaries

Create custom baskets combining traditional securities with digital assets

This interoperability stands to benefit both retail and institutional Robinhood clients. Morgan Creek Digital founder Anthony Pompliano called it "the financial equivalent of the internet revolution—different protocols all speaking the same language for the first time."

Direct User-to-User Trading

Perhaps most revolutionary is the potential for direct trading between individual Robinhood users. In this model, the platform would serve as infrastructure rather than intermediary, allowing users to create their own markets.

"Imagine trading your Apple shares directly for Bitcoin with another user, or exchanging equity positions for sports betting contracts with no middleman," explained Robinhood's head of market structure. "We're building the rails for an entirely new financial paradigm."

Banks and financial institutions are taking notice. JPMorgan, Goldman Sachs, and Fidelity have all accelerated their blockchain initiatives following the administration's regulatory shift, suggesting Robinhood may soon face formidable competition in this space.

The Financial Impact

For investors, Robinhood's tokenization initiative could address longstanding concerns about revenue diversification. Currently heavily dependent on transaction-based revenues, the company stands to build more stable, recurring revenue streams through tokenization services.

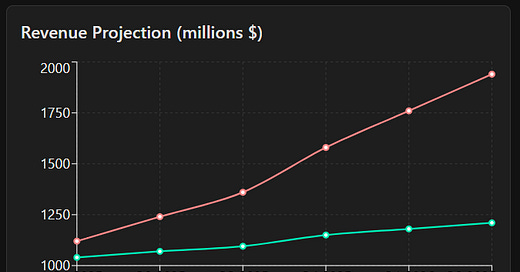

Financial projections suggest the initiative could contribute significantly to Robinhood's bottom line within 12-18 months of full implementation:

Potential for 25-30% revenue growth acceleration

Margin expansion of 10-15 percentage points

Reduced revenue volatility through diversification

New institutional revenue streams previously unavailable

Looking Forward

While technical and regulatory challenges remain, Robinhood's early mover advantage and the current administration's supportive stance give it a unique opportunity to reshape financial markets.

"We're witnessing the beginning of a fundamental reordering of how financial assets are owned and traded," said Catherine Wood, CEO of ARK Invest. "Companies that successfully build the infrastructure for this transition stand to benefit tremendously."

For Robinhood, which has struggled at times to find its footing since its 2021 IPO, tokenization might not just represent a generational product line—it could define the company's future and its place in the next generation of financial services.

The real question now isn't whether tokenization will transform financial markets, but whether Robinhood can execute quickly enough to maintain its first-mover advantage in what promises to be an intensely competitive new frontier.

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/Investwithmeh or visit my X @Oshuahill