“We will, we will, DOCU.”

- Queen. Probably.

Intro:

First off, I dont know sh*t about fuc*, so take all of this with a grain of salt, and NFA obviously. With that lets take a look at DOCU ahead of earnings Dec 7th.

Anecdotes / Vibes:

Read the room, stocks have been in business as of late, and business is booming. I personally don’t use Docusign much, I do sign docs and send to customers via their site, when they mention its their preference, thats about it. Back to business, look at ADBE, one of DOCUs competitors in the secure documents space. Its near ATH and just over $600 at the time of writing this, while DOCU langushes. Just on gut fill, which means nothing, I’d say that DOCU hasnt participated in the recent rally, the vibes are off, and it needs to play catch up. So, lets take a look and do a Vibe check.

Charting / Crayons / Astrology (duh) for stocks:

DOCU is still a pretty young company, so lets look at the 5 year weekly chart, that covers it back to IPO.

Right out of the gate you’ll notice this bad boy is trading at essentially IPO levels. Yikes, right, do we think this company should be trading at 2018 levels? Well lets look at this on a market cap basis, maybe shares were added thats not reflected in the share price.

Welp, that aint it. So on this alone, confirmed, not rallying to the same degree as broader market and near ATL( all time low). Shares outstanding havent changed really since 2019. Lets see that SPX to DOCU comparison in a neat chart.

Magenta here is the SPX (sp 500). The SPOO YTD is up 19.07% while DOCU is DOWN 17.85%. Notice that point of control in the volume bar on the right, red, its at $56.52.

So lets take a peak at some levels on the daily for DOCU below.

Now this doesnt seem so bad, youll see the saucer bottom and smiley face forming, we are also just underneath previous support! So interesting levels indeed. Plus we have the 20MA crossing over the 50MA and both curling up to the 200MA which is haning out at around $50.

Just looking at the charts, I would think $50 is feasible with a breakout to $56 POC. But lets look at some financials to confirm if this means anything.

Techincals / SEC 10-Q / Stats:

Lets start with some revenue statistics to gain a longer term perspective of where we sit, in billions.

You’ll notice two things out the gate, they’re making way more money than in 2018 but trading at the same levels. The other thing is their drop off in growth.. ouch. They make 2.65B TTM now vs. just 0.5B TTM in 2018. Thats impressive, the downside is that its dropping y/y. I dont think this is enough to keep them trading at the same valuations however, 2023 was still up 19.4% from 2022. Its hard to really grasp because COVID pulled so much forward.

Looking at the net income - its hard to understand why this is beoming profitable while trading at the same levels it was when it was losing loads of money (Growth I guess).

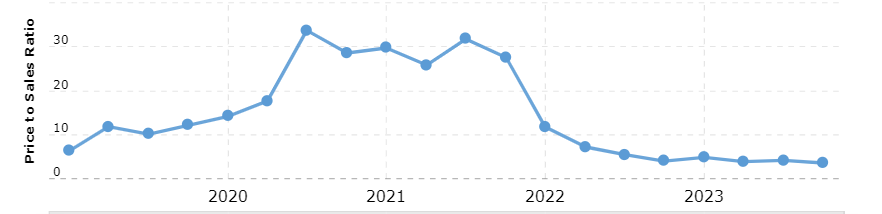

Lets take a look at Price to sales (P/S) and Price to book (P/B). We cant really look at Price to earnings (PE) because its negative currently.

Historically low price to sales.

Same for price to book.

We cant really look at PE, but we can see the EPS TTM, its very close to breaking positive and may actaully happen this quarter…maybe. So lastly, lets look at Margins.

Nothing much to say here other than, its headed in the right direction on all fronts as far as margin. Net is almost positive.

OK, lets see Financials. 10-Q from the last quarter Q2 2023.

I always look at cash on hand and cash burn before anything else. I dont think I have to worry about dilution here, but its worth a check. Looking at the cash above its about 1B (only care about cash and equiv). Note - the contract liabilites makes me nervous, but lets look at cash v. net income.

So 1B cash on the books but they burn…..wait, their net income is postive. Thats great. No dilution here. The last S1 filed was in 2020, it looks as though all those issued shares are already into the float. 15M units worth.

OK, there are 100 other things too look at here, but tldr, cost of rev v. revenue is balaning out, they are spending more money to make more money and they have done so in a way to come out positive on the net. I dont really care about that though, Ill explain in the conclusion.

Other Stats:

Lets take a look at ownership and float.

The float of 200M shares isnt giant but it isnt small either, no small float squeeze type play here. but it is almost 80% held by tutes, the insider ownership is meh. It’s also 3% short, not worth writing home about. This would imply if DOCU keeps the course, tutes likely wont dump into a rising market and that would lock up about 80% of the float. Espeically if they are on the verge of positive EPS and profitability.

Conclusion:

This is just a glance, I think they hold the line with upside of positive EPS and continuation of net income in positive territory. Their numbers are trending in the right direction even if they arent growing at covid levels (which almost nobody is). Looking at PS, PB, MC and some of the other factors mentioned, it might not rip to the moon, but I think it’s bottomed for a while, barring bad earnings. And in this environment, as long as it isn’t awful, the rising tide will keep this ship afloat. I won’t really worry about some of the financing data, this is a short trade on the basis of, “do I think it will hold this level”. Thus I don’t have an upside target, my position is 10 45.5/45 put credit spreads for 12/8 at 0.25 credit. My breakeven is 45.26 and anything over 45.5 and I get 100% profit of $250. This is purely an earnings play based on the data above. The downside just doesnt appear to be there with the data we have and the market we are in. This passes the vibe check for me. It may not rip to POC at $56 dollars, but I am just betting it wont close below 45.5 on Dec 8th.

Closed this out today 100% gain. Was nervous on the open dip but it was bought up in 30min.