Intro:

Welcome to the Family Madrigal. Today I will be looking into Madrigal Pharma (MDGL). This will be a trade adjacent to the one I wrote about for Altimmine (ALT) back in early December. Similar to Altimmune, Madrigal is a single product company which focuses on the treatment of NASH (non alcoholic steatohepatitis) and NAFLD (Non Alcoholic Fatty Liver Disease). Their lead drug candidate is named Resmetirom and would serve a total addressable market (TAM) of around 20B as of today, projected 30B by 2030. Currently there are no approved treatments specifically for these diseases. Akin to this space would be what you have seen, to a lesser degree, in the obesity space with GLP-1 behemoths NVO (Novo Nordisk) and LLY (Eli Lilly) leading the way. Sitting at a paltry 4.67B MC (Market Cap) it leads its peers in the NASH space, but falls miles below the current NVO and LLY MCs which are sitting over 500B. Both companies along with ALT and Viking Therapeutics (VKTX) hope to enter this 30B TAM space by 2030. Granted these treatments offer a smaller TAM than the projected 100B for obesity, it’s still nothing to sniff at.

Now, lets try to piece together this vision.

Background:

If you want to get a deep dive on the company itself and the drug trials leading up to this point for Resmetirom, check out this write up below by

.Potential Negatives:

Some of these may echo the article above, but I will try to add additional concerns.

Patent expirations - I wont go into details here since it’s covered already in the link, but this will have a major impact on the long term runway for this stock and its lead candidate.

Other GLP and NASH treatments entering the market and how this will eat into market share. We saw this stock tank back in early Feb of this year, simply on the echos of comments made by LLY in their earnings call. The compound which is already approved under the names Zepbound / Mounjaro could also, potentially, treat NASH. The same is true of incoming competitors VKTX and ALT.

This being said - the next closest for FDA approvals looks to be around 2027 at the earliest so that will give MDGL first to market mover advantage for the next 2 years.

And obviously there is risk that they wont get approvals in the upcoming PDUFA March 14th.

I think it won’t be easy for MDGL because this one is not a clinical outcomes study. It hardly works for early stage NASH indirect noninvasive markers, and it won’t work for F4. Is mortality from liver disease reduced or complications reduced? This is still an unknown. Endocrinologists have concerns about the effect of RES on hormones estradiol, testosterone, and thyroid hormones and the long term outcome effect of dis regulating these hormones. We saw with ICPT that the general public only looks at these risks and unknowns superficially but FDA takes them very seriously.

Charting / Crayons / Astrology for Stocks:

Our first chart below will take a look at the major trades made for MDGL in the past year.

You’ll notice there has been a load of activity since the Phase 3 data released Nov 10, 2023. Maestro-NASH Phase 3 Data

Including the number 1, 2, 9 and 10 trades all time very near the currently market price of $236.

Given the recent popularity of Obesity drugs and their potential, I believe the NASH market will behave similarly. Looking above, the POC (point of control) in red, for the past year, is right at $240. Looking further back at the 3 year you will see previous POC prior to their Phase 3 data was around $70. This to me would be the absolute floor.

Here we see the 5yr daily chart. The stock sits above the 20, 50 and 200MA with a 50/200MA golden cross on 1/22. This was recently derailed by the LLY news, but LLY is still a ways away from NASH approvals. I would see the 200MA as support around $200 prior to approvals and then a range of $100-500 depending on approval. With support at 100, previous tops from 2022 and resistance above in the 500 area representing 10B MC. The chart is still in a very strong bullish trend, failing to make lower lows in Oct 23 and now making higher lows and higher highs, a break above previous ATH would be a blue skies breakout which is possible with FDA approvals in 3 weeks.

Financials / Stats:

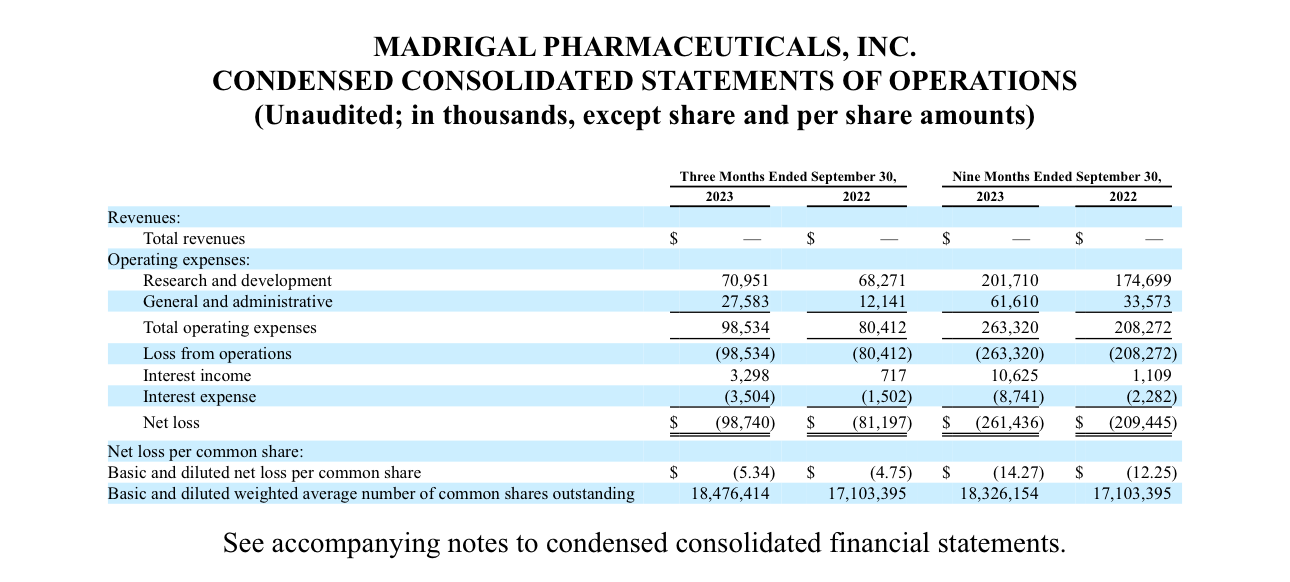

Below is the 10-Q filed in Novemeber 2023. Since this is a small cap, the first thing I want to look for is cash on hand and the potential risk of dilution. You don’t want to be exit liquidity for a share raise.

As stated in the filing, they have about 67M cash on hand and short term treasury investments. BUT, not included here is a 500M share dilution which was performed last year after this report, in total they have nearly 600M in cash and equivalents. Now let’s see what they burn in a quarter.

Based on this it looks like there is about 1-1.5yrs of cash burn left. That is plenty of runway to get to their advertising and manufacturing campaign going, summer of 2024. There is also buyout potential here should they get approvals this month. At which point the cash balance no longer matters.

Lets take a peak at the float, ownership and SI (short interest) stats:

Fairly small float - 12M and around 26% short, with the recent run up, that number is possibly higher. This is pretty significant if you’re hoping for volatility and a squeeze upside. The bears are giving this the hug of death.

Institutions control this stock and will base their holdings on the upcoming PDUFA decision. Expect a big move here, one way or the other. With Super Micro (SMCI) fresh on everyone’s minds with its low float and options gamma, we could see something of that nature play out here.

All in all, there is low risk of dilution in the near term and high potential for massive move in the share price.

Conclusion / Position:

I think this stock is likely a buy, even with the move up in share price over the past year. It is trading at a discounted valuation (assuming approval) for a company with a first to market NASH drug. There will be support below with the 200MA at $204, resistance at the point of control at $240 and previous highs around $322.

Also, consider there is no case for dilution and that based on technicals and previous positioning, the upside is about 1:1 that of the downside given a $100-500 range. The TAM is large enough today to justify this at 10B MC post approvals and they are far enough ahead on the competition that a CRL from the FDA wouldn’t kill them, as they could adjust based on the FDA findings and resubmit to attempt approvals in 6 months.

Right now I don’t have an open position but I am looking into Cash Secured Puts and possibly a Strangle for the PDUFA date. The IV (implied volatility) is very high and rising as seen the chart above. This is ripe grounds for premium.

The CSP I am looking into is the March 15th $150 sold put for around $1450 premium and would put me at a $135.50 cost basis should they get rejected and tank below $150. As seen below the $150 puts have alot of open interest.

The other trade I would open along side this is a Strangle with at $50 spread for the April 19th date. The $200 / 300 call and $140 / 210 put have decent open interest. Based on this area and the current market price, I would look to open 260/210 long strangle buying the 260 call and 210 put. My breakeven would be $140/330 on each side, which lines up with the $150 CSP on the low side. This would risk 7K max loss.

With both of those open - max loss in the worst case is 5.5K (7K-1.5 from he CSP) - should the price stay between 210/260 after the PDUFA date.

However, based on the event, float, SI and IV. I dont think that scenario would come to fruition. Best case is this blasts past $330 on approvals and both my CSP and Strangle profit. The same is true if it tanks below $140. I get shares at a cost basis down towards $100 once adjusted for premiums. The dream would be $500 (10B MC) post approvals as it would net around 18k.

“You miss 100% of the shots you don’t take” - Michael Scott

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/mehmehmeh