Intro:

It has been too long since my last write up, the holidays and New Year’s resolutions got the best of me this year. I hope everyone has rang in the new year in the best ways possible.

Before we get into the topic of Novo Nordisk (NVO). I wanted to share the quote below:

As we get into the discussion of this particular equity I want you to keep this thought with you. We will look at the chart and you’ll immediately realize that almost anyone who’s purchased shares, ever, is now in profit. Human nature would tell you, you’ve done great, look at those gains, sell and reward yourself! But as someone whose traded in and out of this stock the past year…..reconsider, please.

Background:

I had considered penning a formal write up on NVO for sometime. About 3 months ago I got into a debate with a friend from work, which lead me to draft a Reddit post. Let’s begin with a short history lesson, because I believe it’s important in this case. NVO is a Danish Pharma company and was founded in 1923…..yes 1923. They currently have 64,319 employees and unlike some of the tech giants recently, have not been laying folks off to buffer their numbers. For the last couple of decades NVO has focused on cornering the insulin/diabetes market, and with great success. As of today, they own 1/3 market share of the entire industry and share a duopoly with Lilly (LLY) in the obesity space.

Image form, for the reading impaired, below. Sorry it’s not in freedom units, hopefully you can math, 1 DKK is 0.14 USD.

Valuation:

NVO recently reported 0.71 EPS and in 2024, Novo Nordisk expects sales to grow in the range of 18-26% at CER (constant exchange rate), while operating profit growth is expected to rise 21-29% at CER. More details here in their Financial report.

Using this as our baseline, let’s project out through EOY (top row) and through 2025 (bottom row). Right now NVO trades at a rich 42.75 PE (price to earnings) and closed today right at $114 per share. Given their guidance (which they increased twice last year) we can get an idea of the forward valuation, below.

I was pretty conservative with the EPS estimate, this is based solely on the mid line of their guide and does not account for any guidance up over the year, OR any label additions to Wegovy or Ozempic for cardiovascular disease or chronic kidney disease. I also discounted for less growth in 2025 due to potential competition and market saturation. But even at these levels, to trade around today’s PE, you’d be looking at the share prices below, 142$ end of 24’ and $170 end of 25’.

Potential growth is still there, representing around 25% for this year and 49% through 2025.

BUT 42 PE FOR A PHARMA COMPANY IS CRAAAAAZY.

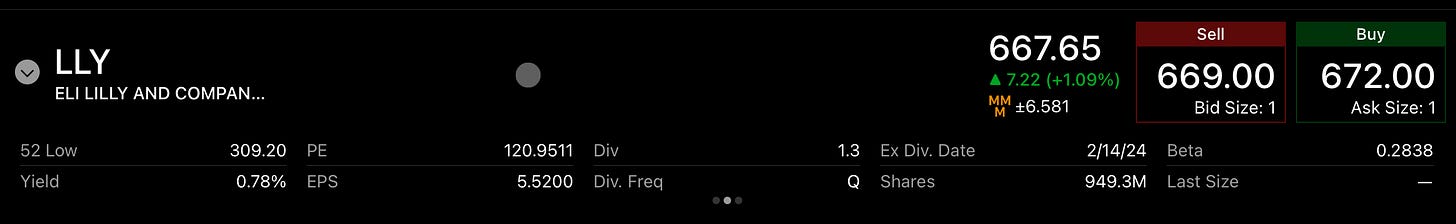

What if I told you, their biggest competitor, who has a late start and hasn’t had to deal with manufacturing ramping/supply issues is trading at a 120 PE?!?!?! Yes, LLY is trading at, you heard it right, 120 PE.

Charting / Crayons / Astrology for Stocks:

There really isn’t much to say here, let’s look at the all-time weekly chart, for fun, you can see where the obesity market kicked in.

Yes. This is insane, which is why holders may be tempted to sell and buyers may be shy to buy. I can’t even TA this, its fully into unknown territory.

Growth Potential:

Aside from the weight loss drugs everyone is crazed about. Novo controls 1/3 of the diabetes market world wide and 1/2 of the insulin market, as previously mentioned. They are no one trick pony, as well as the expanded targets below.

SELECT trial:

NVO released their SELECT trial data in Dec2023 and it was a smashing success, reducing cardiovascular events by 20%. The trial enrolled 17,604 adults aged 45 years or older with overweight or obesity and established cardiovascular disease (CVD) with no prior history of diabetes, using semaglutide 2.4mg. NVO submitted EMA and FDA label approvals to add this to their drug. EMA actually met last week to debate this addition but didn’t reach a decision. I expect this soon and I expect it to be approved, further boosting the valuation.

FLOW trial:

FLOW is a superiority trial comparing injectable semaglutide 1.0 mg with placebo as an adjunct to standard of care on kidney outcomes for prevention of progression of renal impairment and risk of renal and cardiovascular mortality in people with type 2 diabetes and chronic kidney disease (CKD). 3,534 people are enrolled in the trial which has been conducted in 28 countries at more than 400 investigator sites. The FLOW trial was initiated in 2019. This trial completed in Oct2023 AND ended early because the data was so good. This data will be shared Q1 2024, further improving their product line and indictions.

Insurance:

80% of insurers already cover their drugs. With the new indications and approvals on those, that number will be close to 100% one day. Healthy employees/customers, less need for insurance. Companies will agree to this even at the seemingly high cost of the drugs because it will save them from covering major medical bills. The EU has already started working to have this covered in several countries. EU Support

Potential Downsides:

Pretty obvious, it’s possible that none of the stuff above gets approvals. The other pitfalls would be losing market share to LLY and other companies who get approvals in the next few years for similar drugs. There are also Supply issues that have plagued them the last two years. Not being able to introduce new patients is an huge risk to market share. Lastly would be regulatory issues or unforeseen adverse side effects of their drugs which puts their revenues into the shadow realm.

Conclusions:

Novo Nordisk has possibly the best management in the pharmaceutical industry. This has been shown time and again for the last 100 years. Their ability to hit milestones and get FDA approvals is the best in the business. They have so much going for them right now, control of the insulin and diabetes market and bordering on doing the same for obesity. These two markets alone would make them a 1T dollar company, one day. Furthermore they have the potential and cash on hand to scoop up smaller companies to expand in these markets and adjacent markets which GLP drugs seem to treat. Cardio disease, NASH, Diabetes and Obesity are massive, 100B plus Annually, markets. This all assumes they continue to consolidate those markets and execute at a high rate. With first mover advantage (similar to TSLA) in obesity, they are on a launching ramp for the next two years minimum. Everyone else is playing catch up. While others like LLY work out the kinks, NVO will be finding ways to expand and improve their margins on existing products like Ozempic that has been approved since 2017. Speaking of which, their patent extends into 2027 on Ozempic and 2031 for Wegovy before they worry about generics. These products have already been successfully defended in Court.

My target for EOY is still $145, as it was 3 months ago. Right now I hold 10x 125 calls for 6/19 expiration. I recently had shares called away and sold my 6x 2/16 105 calls after earnings this week. That money was used to roll forward into the 6/19 calls. I will ride this train till the wheels fall off.

Remember the quote above, trade the chart, not your feelings. Hold your winners, cut your losers. NVO is a winner.

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/mehmehmeh