“TNA, you fat lard!”

Probably Napoleon Dynamite

Intro:

The Caps are small, but the gains are not. No Cap.

I have been thinking of writing up a case for small caps for a few of weeks now. One of my last notes from my TLT post called out my expectations for small caps leading into 2024. Thoughts on small caps into EOY from Dec 12th. Since that time TNA has rocketed up 28%. Sadly my covered calls from the shares I purchased at $28.75 have long been called away at $33. I was not prepared for such a rapid move up after the last FOMC meeting and Powell’s (FOMC Chair) dovish rhetoric. As of this writing, TNA is trading at $41.29. That being said, with a little help from the macro environment, this still has room to move higher. Let’s dig in.

Backdrop and Set-up:

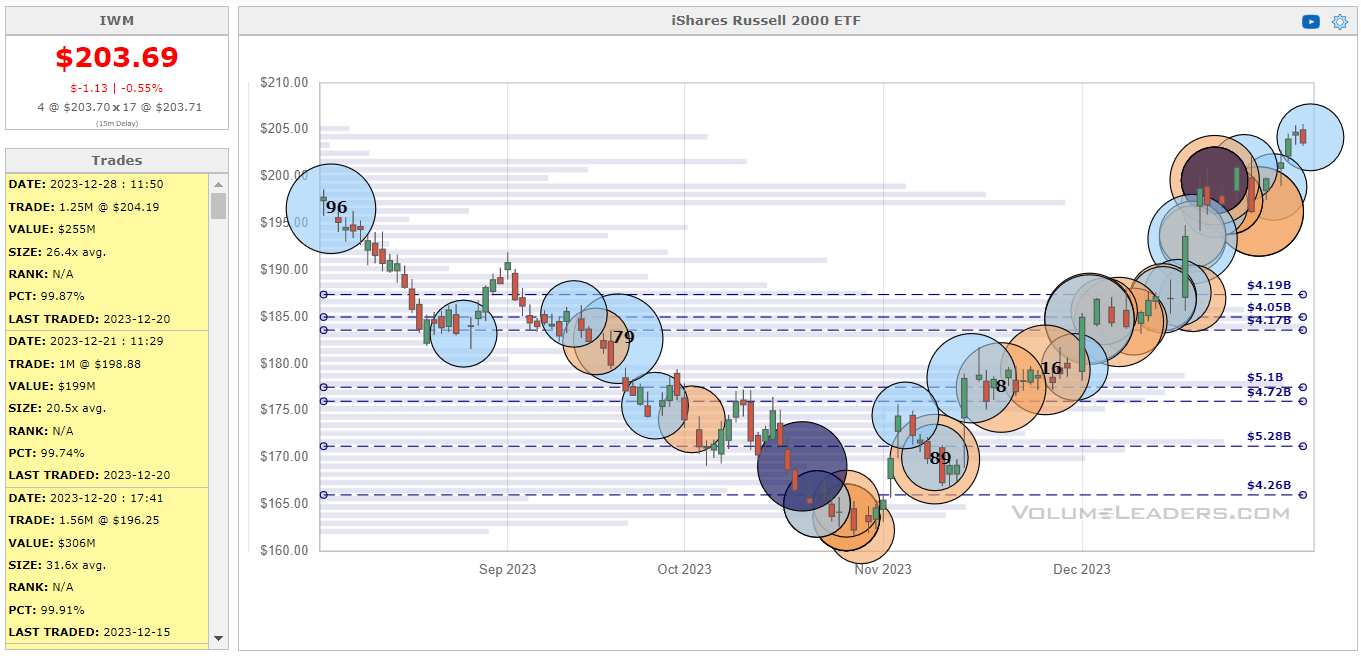

As the Fed hiked interest rates, small caps languished while the venture capital to support these companies dried up and as loans grew scarce with higher interest rates. Now that we seem to be escaping this restrictive environment we should begin to see a run on small caps. Let’s start by looking into this set up. There are a few things I really like, and I will use TNA’s big brother IWM (Russell 2000 small cap index), to distill my views. First I want to look at trade volume data, courtesy o volumeleaders.com , as of today:

A majority of the circles represent single trades that are greater than 99% of all trades ever made on IWM. There are a few trades, given where we were historically, that stick out to me, and that I think were buys. The number 8 and 16th largest trades ever were placed around $180 at the end of November, just ahead of the Fed decision and CPI data in December. Around that time we had already seen softer data in both the jobs market and on the inflation front. I detail all of this here in, The Case for TLT. A smart trader placed an educated bet ahead of these events. I can only say this with some certainty, but they are such large trades, it would seem logical that they were bullish given the circumstances around that time. Also, worth pointing out they are nice round numbers, traders usually enter with nice whole numbers like 1M. Either way, nobody expected Jpow to go full, “when doves cry” on FOMC day. So they were lucky if it was a buy.

That is where we stand today. Big trades are being made and the macro headwinds are letting up. Let us look at some pictures!

Charting / Crayons / Astrology for Stocks:

This is what I find very interesting, if you’re into the witch craft of charting. IWM is sitting at some very important technical levels, lets see the 10yr timeframe.

Two things, small caps are breaking out from a long held range between $160-200 and we are breaking above a very long term mid-trend line, in red. If we can hold $200, I think this pushes higher, but a retest of the mid 190s is also not out of the question. This wouldn’t shock me short term, but I am thinking for the full year 2024 here, so a pull back after this run doesn’t concern me.

One other thing I would like to point out is where the small cap index stands relative to its all time highs (ATH). If we do get into a friendlier rate environment, I don’t see why we can’t retest those highs, after all, its peers, QQQ and SPY are both testing or at their ATH right now! Seen below.

By that measure the Russell 2000 has another 16% of room left to run - which is 48% for TNA as its 3x leveraged. And it’s coming out of a cold cold winter.

Lastly, I want to show the moving averages:

Red = 200SMA, Yellow = 50SMA, and Green = 20SMA (simple moving average).

We are on the verge of a golden cross (50SMA crossing over 200SMA). Considering the other points noted above, this looks like it will break higher. These MAs and the 20SMA should be supports too, we have several supports from $200-180. The downside risk here isn’t that bad. Unless something changes on the macro level, we won’t sniff $180. But let’s discuss those risks anyway.

Potential Downside:

Starting off with the glaring divergence in expectations vs. what the Fed is saying, in relation to the rate cut expectations for 2024. As we stand, the Fed is leaning towards 3 cuts in 2024 according to their FOMC economic projects, seen below, around 4.65 mid:

However! The market, in its infinite wisdom, is pricing in up to 7, count em, 7 cuts. Sorry for the sloppy highlight job. 5.25 to 3.50.

This presents a pretty harsh reality for small caps if we don’t get those expected cuts, even worse if we get less, or lord forbid…..a hike.

Walking hand in hand with this are concerns over, war, inflation, deflation, slowing economic growth, elections and so on. You can come up with any number of problems for this trade, but this is true of all trades. It’s just good to be aware of the potential pitfalls so that you’re on the lookout for a turn in any one of these. This allows you to monitor your perspective and adjust accordingly.

Conclusion:

Given what we know, not what may be, I am looking to open a TNA position again. I’d prefer a pullback under $200 on IWM and to get TNA in the mid 30s. En lieu of that, I will write a cash secured put or a put credit spread somewhere in the $30s. This is a trade that will need heavy monitoring of economic conditions and what rates are up too. It’s probably also good to look at other small cap ETFs in individual sectors, to see how they are doing. One of the most beat down sectors was Bio in 2022-23, so something like LABU can possibly give an early warning, as it will be the first to sour.

Currently I have no open position for TNA or IWM. I’ll update with a comment when I do.

“For everything there is a season, and a time for every matter under the heaven” - Ecclesiastes 3:1

Please hit the “like” button above if you enjoyed reading the article, thank you. You can also see all of my trades at: https://thetagang.com/mehmehmeh

Just built out my first 100 shares. 38.36$. Opened a covered call at $40 for Jan 19. Will keep adding and run a wheel on this if need.

Opening a new position here this morning at 41$. 25 shares of TNA. I want to scale into this one and look for a pull back in Jan sometime by VIX and opex Jan 19th. Once I build out over 100 shares I’ll start writing some calls. I am looking to also add put credit spreads or sold puts on dips. Cheers to 2024