Intro:

While I have been deep into HOOD 0.00%↑ for the past year, the past few months I’ve been looking for the next breakout stock in 2025. Since their last earnings report I have been eying TSSI 0.00%↑ - I mention it here (SSI v. SMCI Cast) in my podcast from November2024 when it was still trading around 8$. As you can see it’s up nearly 100% since then.

Everyone remembers the insane run SMCI 0.00%↑ made last year when the AI narrative seemingly took off for Mars. Lets look at their risk and fall. The fall of course, mostly due to accounting fraud “allegedly” and SEC backlash. We can get into this later.

Using Super Micro Computer (SMCI) as a proxy, let’s compare the two to get an idea of where TSSI could go.

TSSI v. SMCI Financials

TSSI v. SMCI Narratives

TSSI and SMCI Multiple Comparisons

2025 Product Roadmap and Catalysts

Let’s dive in.

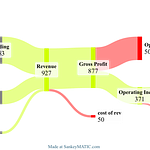

TSSI v. SMCI Financial Breakdown:

First let’s focus on revenue growth, this is a key indicator of a companies ability to scale and expand its market presence.

TSSI has demonstrated significantly higher revenue growth compared to SMCI, with its most recent trailing twelve months (LTM) revenue growth at 140.7%, whereas SMCI stands at 109.9%. Over the years, TSSI has shown consistent acceleration in revenue growth, highlighting its increasing market demand and operational efficiency. This could stand to change further in TSSI’s favor, soon, with higher scrutiny of SMCI and their earnings reports by the SEC.

Listen to this episode with a 7-day free trial

Subscribe to Invest with MEH to listen to this post and get 7 days of free access to the full post archives.